Changes in cash from investing are usually considered cash-out items because cash is used to buy new equipment, buildings, or short-term assets such as marketable securities. But when a company divests an asset, the transaction is considered cash-in for calculating cash from investing. In the case of a trading portfolio or an investment company, receipts from the sale of loans, debt, or equity instruments are also included because it is a business activity. Understanding how to create, interpret, and effectively use financial statements is pivotal for strategic decision-making. Financial statements, particularly, are essential tools that extend beyond simple record-keeping that can guide your business strategy.

Is there any other context you can provide?

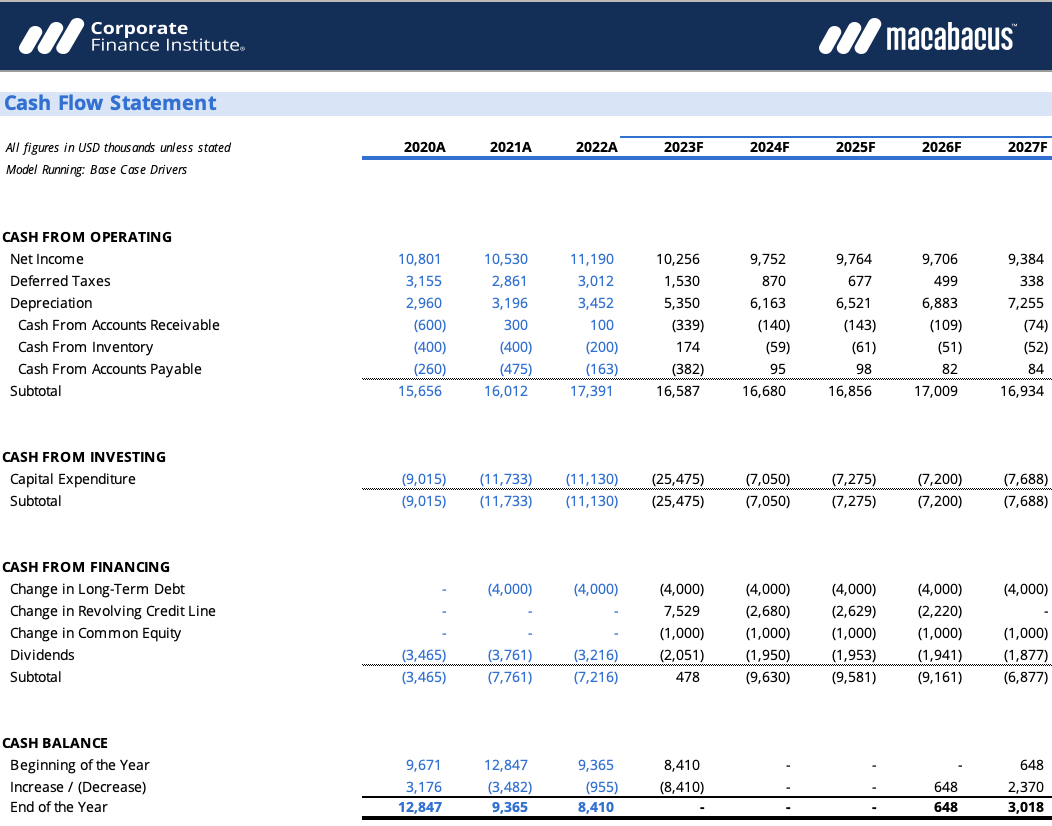

Accountants follow specific procedures when preparing a statement of cash flows. After determining the change in cash, the first step in preparing the statement of cash flows is to calculate the cash flows from operating activities, using either the direct or indirect method. The second step is to analyze all of the noncurrent accounts and additional data for changes resulting from investing and financing activities. The third step is to arrange the information gathered in steps 1 and 2 into the proper format for the statement of cash flows.

Cash Flow Statement: Definition

The statement of cash flows is one of the financial statements issued by a business, and describes the cash flows into and out of the organization. Its particular focus is on the types of activities that create and use cash, which are operations, investments, and financing. A cash flow statement tells you how much cash is entering and leaving your business in a given period. Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating. The cash flow statement measures the performance of a company over a period of time.

Cash Flow Statement (CFS)

But as you become more familiar with the language of financial statements it may become easier to make sense of them. Some investors may also use the cash flow statement to help them decide whether or not to invest in a stock, such as by looking at free cash flow per share, or calculating a present value of estimated future cash flows. Under this method the starting point is the net income reported on the income statement. The cash flow statement is required for a complete set of financial statements. In the above example, the business has net cash of $50,049 from its operating activities and $11,821 from its investing activities.

In the current year, Clear Lake took out additional notes payable (a cash inflow). We can see this by the increase in their notes payable account from the prior year to current year ($40,000 to $50,000). Dividends of $30,000 were paid to shareholders (found on the statement of retained earnings and the statement of owner’s equity).

Useful as a Basis for Short-Term Planning

- Operating activities detail cash flow that’s generated once the company delivers its regular goods or services, and includes both revenue and expenses.

- In the case of a trading portfolio or an investment company, receipts from the sale of loans, debt, or equity instruments are also included because it is a business activity.

- This approach lists all the transactions that resulted in cash paid or received during the reporting period.

- In other words, the operating section represent the cash collected from the primary revenue generating activities of the business like sales and service income.

- Then, we’ll walk through an example cash flow statement, and show you how to create your own using a template.

The main components of a cash flow statement are cash flows from operating activities, investing activities, and financing activities. This section reports cash inflows and outflows that stem directly from a company’s main business activities. These activities may include buying and selling inventory and supplies and paying employee salaries. Any other forms of inflows and outflows, such as investments, debts, and dividends, are not included. Greg didn’t invest any additional money in the business, take out a new loan, or make cash payments towards any existing debt during this accounting period, so there are no cash flows from financing activities.

Cash flow statements have been required by the Financial Accounting Standards Board (FASB) since 1987. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All trump’s tax plan such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. The changes in the value of cash balance due to fluctuations in foreign currency exchange rates amount to $143 million.

The reason is that not all business transactions can be adequately expressed as amounts on the face of the financial statements. The cash flow statement is the name commonly used by practicing accountants for the statement of cash flows or SCF. We will use these names interchangeably throughout our explanation, practice quiz, and other materials. You can earn our Cash Flow Statement Certificate of Achievement when you join PRO Plus. To help you master this topic and earn your certificate, you will also receive lifetime access to our premium financial statements materials. These include our video training, visual tutorial, flashcards, cheat sheet, quick test, quick test with coaching, business forms, and more.

Changes made in cash, accounts receivable, depreciation, inventory, and accounts payable are generally reflected in cash from operations. By comparing cash as reported on a current balance sheet with cash as reported on the balance sheet at the end of the preceding year, we can see how much cash changed—but not why it changed. Cash flow refers to the amount of money moving into and out of a company, while revenue represents the income the company earns on the sales of its products and services. Cash flow is the total amount of cash that is flowing in and out of the company. However, the cash flow statement also has a few limitations, such as its inability to compare similar industries and its lack of focus on profitability. This information allows businesses to forecast future cash needs, make informed investment decisions, and track actual performance against budgeted targets.